Being Rich For a Few Minutes

Since the beginning of the covid19 outbreak and the stock market crash, I’ve been investing in stock markets. Many companies’ stock exposed bargains. Among them, I invested in the oil and gas company : Chesapeake energy. I bought 1500 shares for a modest share price of 13 cents.

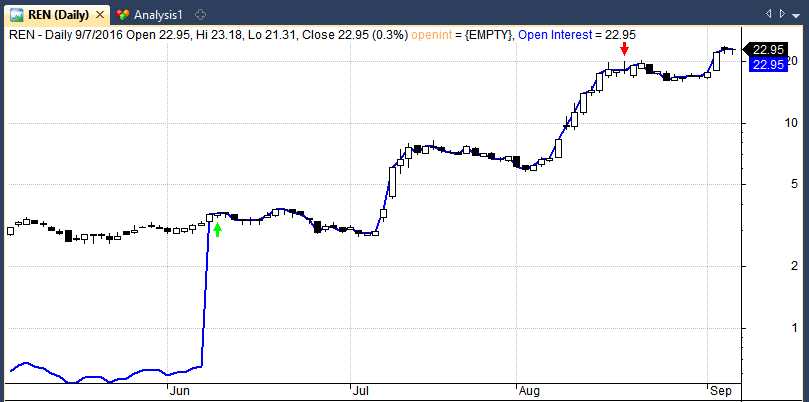

On the night between 04/15/20 to 04/16/20, the cost of this company`s shares surged from 13 cents to approximately $20, which made my worth increase by around 30 thousand dollars. I was the savviest trader on wallstreet. Although it sounded too good to be true, I began imagining how I could spend this money. Would I go on trips and explore the world or would I reinvest the money? The initial euphoria became frustration after multiple attempts to sell my shares were declined: the panic started coming over me.

My hopes to become rich were completely dashed when I learned about reverse stock split. To avoid a delisting from NYSE (New York Stock Exchange), Chesapeake company and it’s shareholders voted for a 1-for-200 reverse stock split. This meant that the price of the share is multiplied by 200 but the total number of each investor’s share was divided by 200.

My brocker account ‘Revolut’ took some time to process this change; I was not a rich trader.

Amine